For the first time in a marathon of mass layoffs, pandemic adjustments, AI-driven disruptions, and the US’ resumed tariff negotiations, the US tech jobs market of 2025 is no longer on fire, but it is not freezing. We’re seeing a strategic recalibration: Companies aren’t forcing employees into mass disengagement like in 2021, nor are they sending thousands of employees a week into crisis like in 2023. Instead, the tech industry job market is becoming more agile, targeted, and ruthlessly efficient. Compared to the unpredictable volatility of 2023, 2025 marks a more intentional, albeit unforgiving, pace in hiring.

As someone deeply involved in tech hiring, we can tell you this: the balance of power has changed. Companies that are good at hiring with AI and strategic decision-making have unprecedented access to individuals previously trapped in big tech. Talented candidates are switching gears early, reskilling, specializing, and moving into high-velocity fields like AI security, cloud automation, fintech infrastructure, and digital health.

This new wave of job mobility is driven by adaptive learning platforms, upskilling programs, and a job market that prioritizes demonstrable skills over brand-name experience.

So, how is the tech job market right now? Not exactly, but it’s maturing. For employers and job candidates who grasp the new rules, this could be the most strategic moment in ten years to make hires or get hired. Let’s talk about it in detail!

Tech Layoffs 2023–2024: A Reality Check

From 2023 to 2025, the tech industry job market experienced a significant personnel decline. Over 264,000 tech employees were laid off in 2023 alone worldwide, with over 95,000 in the United States. The cut continued through 2024, when approximately 152,000 jobs were cut. Through early 2025, over 26,000 additional tech market jobs were cut, indicating ongoing reorganization within the industry. Layoffs, however, are increasingly focused and no longer reflect panic-driven mass cuts. Instead, they’re part of organizational rebalancing strategies aimed at adapting to AI-driven productivity models.

The reductions were widespread but varied. Most firms focused on reducing non-core jobs, middle management levels, and underperforming units. Mid-management, human resources positions, and lower-level posts were the most brutal hit.

Despite these reductions, tech job growth in specialty areas remains constant. Companies including Bank of America, Chase, and Wells Fargo have hired software engineers, AI engineers, and cybersecurity experts. This shift reflects a broader industry trend toward prioritizing jobs that drive innovation and security. The key hiring mantra? ‘Build what automates, secure what scales.’

Notably, while some companies lay off workers in traditional roles, they simultaneously expand staff in artificial intelligence and cloud computing. For instance, Salesforce laid off over 1,000 employees in early 2025 but continued to recruit for AI-focused roles.

Similarly, Microsoft laid off around 6,000 employees, citing organizational realignment and increased usage of AI-generated code. The changing environment implies that although the job market for tech has had to deal with difficulties, it is also evolving. Firms are re-shaping their workforce to meet new technologies and business needs, signaling a strategic realignment instead of decreasing the sector’s vitality.

- How the U.S. Tech Job Market Is Evolving in 2025

Major financial firms, such as JPMorgan, Goldman Sachs, and Morgan Stanley, are aggressively adopting AI to automate critical tasks, including IPO preparation and economic analysis. This is creating a massive demand for AI and cybersecurity specialists. Investment banks like Evercore and Barclays are also ramping up hiring, particularly in the tech, healthcare, and industrial sectors, as they prepare for a “crazy” year of recruiting in 2025. This recruitment surge isn’t limited to coding roles—data analysts, prompt engineers, and AI risk auditors are also in high demand.

Another funding outraise pits AI startups against each other. For example, Bat VC announced its second $100 million fund to fund US and Indian startups in fintech, enterprise software, and AI.

In healthcare, companies like Omnicell have developed in-house innovation centers that use AI and automation to optimize drug management and the supply chain. This is also driving demand for AI and systems automation specialists.

The energy industry is seeing growing demand for technicians working in renewable energy, smart grids, and green technologies. By 2025, it is set to become one of the largest tech employers. Digital twins, predictive maintenance systems, and grid optimization tools are becoming hiring hotspots within green energy firms.

The Rise of Nearshoring in Latin America

The nearshoring trend – particularly in Latin America – is gaining momentum as U.S. companies strive to save costs without compromising on quality. Mexico, Argentina, Colombia, and Brazil are favored hotspots. Hiring managers are moving away from the “Silicon Valley or bust” mentality, exploring Tier 1 cities like Bogotá, São Paulo, and Monterrey as extensions of their engineering teams.

Major advantages:

- Cost savings: The average salary of a Mexican senior AI developer is approximately $62,400 per year, compared to $120,000–$144,000 per year in the U.S. (source: Alcor BPO).

- Available talent pool: Domestic investments in technical education are harvesting a strong pool of available talent.

- Similarity and closeness: Time zone alignment and cultural closeness facilitate simpler collaboration and project management.

- Outsourcing trend: The IT outsourcing market in Latin America is forecast to increase to $27.57 billion by 2029, making it an appealing choice compared to higher-cost centers in Western Europe and North America (source: Huntly).

This model supports hybrid development strategies, where U.S.-based teams handle architecture and design, while LATAM counterparts take on implementation and testing.

Despite more restrictive hiring, the demand for senior-level tech talent remains strong. Companies are countering by focusing on strategic recruitment, automation proficiency, and location-based teams through nearshoring. While nearshoring to LATAM continues to thrive, there’s a widening gap between what developers are paid and what outsourcing companies charge. Over the past few years, average developer compensation in LATAM has slightly declined, whereas outsourcing rates have either remained stable or increased. This imbalance allows traditional outsourcing providers to maximize their margins, often without disclosing how much of the budget reaches the developers. Clients end up overpaying – sometimes significantly- without realizing it, as outsourcing providers are not willing to reveal salary breakdowns.

At UnitedCode, we take a fundamentally different approach through our transparent pricing model. Our clients always know how much engineers are paid directly, and our flat commission is fixed and clearly outlined in the contract. This model ensures cost predictability, builds trust, and fosters win-win collaboration where engineers feel valued and clients get true ROI. Today, with AI-powered automation and senior engineers experienced in your domain, a single top-tier specialist can often outperform two mid-level or three junior developers. And with market salaries slightly down, now is the best time to find your hidden gem – affordably and transparently.

How AI and Automation Are Reshaping Tech Hiring

One of the deepest changes in the tech job market outlook is the expansion of AI-based hiring software and the stratospheric demand for machine learning, data science, and automation engineers. Historically, tech hiring used to be all about quickly hiring teams to have projects ready on time. But with today’s lean, productivity-driven economy, companies are seeking precision over quantity. This era of ‘fewer hires, smarter teams’ rewards candidates who can combine technical depth with business fluency.

Why hire three junior developers when one senior AI-capable engineer can build an automated system that scales effortlessly? This logic drives gargantuan changes in job specifications, team structures, and pay splits. For example, a seasoned full-stack developer with LLM integration knowledge or workflow automation skills can now demand 30–50% higher paycheques, especially in fintech, e-commerce, and health tech. These platforms help employers hire with AI—faster, smarter, and at scale.

AI is also transforming the recruitment process itself:

- Recruiters are applying platforms like HireVue, Eightfold AI, and Pymetrics to assess technical skills, emotional intelligence, and behavioral inclinations.

- Artificial intelligence platforms remove unconscious bias by focusing on skills over qualifications, opening the door to a more diverse set of candidates.

- Natural language processing algorithms can analyze resumes, GitHub repositories, and public contributions to align actual outputs with job requirements.

These systems enable businesses to hire more intelligently and rapidly, but in doing so, they set higher standards for applicants. It’s no longer acceptable to just hit the job posting requirements; you must differentiate yourself in a measurable, machine-readable form. Tech candidates must now think algorithmically: measurable skills, quantifiable achievements, and optimized presentation.

The Rise of AI-Powered Recruitment Tools and Software

With the tide in hiring technology shifting to specialization and speed, recruiters are increasingly using AI-driven software to make faster, smarter choices and reduce time to hire. Such software is not just about CV screening—such applications read candidate potential, predict job fit, and streamline entire recruitment pipelines.

Today, tools like Eightfold AI, HireVue, Pymetrics, and Fetcher are the go-to options for HR departments wanting to scale recruitment with intelligence in the United States.

- Eightfold AI charts the career paths of candidates and positions them in ideal jobs using deep learning.

- HireVue allows scoring of video-based tests with AI to quantify soft skills and communication styles.

- Pymetrics uses neuroscience-inspired games and behavior AI to pair individuals with jobs where they will thrive.

- Fetcher integrates AI with outbound sourcing, automatically finding and contacting top talent via email and LinkedIn.

These tools improve candidate quality, reduce hiring bias, and eliminate tedious manual work, freeing recruiters’ time for strategic decision-making. For high-speed tech startups and businesses, that time advantage is crucial. The best recruiters of 2025 are not just relationship builders – they’re technologists.

At UnitedCode, we take it a step further with our own AI-based hiring solution, specifically designed for tech positions. Leaning on years of IT staffing experience, we created a platform that replaces clumsy bulk hiring with smart, data-driven targeting. Our platform utilizes AI testing of hard and soft skills, allowing companies to spot uniquely skilled talent with tight domain specialization and high job-fit accuracy. Learn about our 5-step selection processhere.

The New US Government “Tariff War” and Its Ripple Effects

In 2025, the “tariff war” with China, Canada, and Colombia has rewritten global supply chains and sent shockwaves through the technology sector. The trade policies have accelerated the trend of restoring production in the U.S. and propelled demand for local tech talent in logistics, manufacturing automation, and cybersecurity.

Job Market Impact in Numbers

According to Staffing Industry Analysts, this structural change can have a profound impact on employment trends:

- Job loss in traditional roles: Manufacturing and logistics roles can decline by 10–15%, implying a job loss of approximately 100,000–150,000 jobs.

- Job creation in automation roles: Automation, systems integration, and robotics-related roles are expected to see 20–25% job growth, resulting in the addition of 120,000–180,000 high-skill new jobs.

These shifts are particularly acute in manufacturing states like Ohio, Texas, and Michigan, where traditional manufacturing is slowly giving way to high-tech production models.

Domestic Manufacturing Investments Surge

In response to tariff pressures, U.S. companies are doubling down on domestic production and automation:

- Automation budget increases: Companies raise automation-specific capital investments by 30–40% to offset operational costs.

- New factories for tech: Intel and TSMC are investing billions of dollars in semiconductor factories in Ohio, Texas, and Arizona, creating thousands of engineering and technical jobs.

Despite this investment, a looming talent gap remains. To fulfill the goals of the CHIPS and Science Act, the U.S. will need over 300,000 additional skilled workers, including engineers, technicians, and automation specialists.

Demand Surges for AI and Automation Talent

Tariff-induced supply chain reconfiguration has raised the need for technology talent with niche skill sets:

- Automation engineers to develop and install smart factories.

- Cybersecurity specialists to protect complex, distributed production environments.

- AI developers to design predictive systems for logistics, inventory, and fault detection.

These roles are expected to drive the next wave of recruitment and determine how organizations build their future workforces. This presents a lucrative opportunity for candidates with hardware-software integration skills, especially in embedded systems and industrial AI.

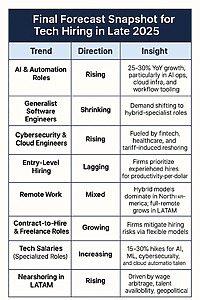

What to Expect in Late 2025?

The global tech talent market is reaching an inflection point as companies react to economic uncertainty, emerging technologies, and shifting employee expectations. Towards the end of 2025, the demand for specialist roles in AI, cybersecurity, and cloud infrastructure is growing, while generalist and junior roles face increasingly fierce competition. Employers are adopting agile staffing models and geographic nearshoring strategies to reduce costs and secure talent. The following summary outlines the most notable trends affecting hiring intentions for the coming months.

In general, the picture looks like this:

Extremely technical tech skills – that is, in AI, cybersecurity, and cloud engineering – will command premium salaries and drive hiring activity up to 2025. At the same time, companies will move away from generalist positions and junior employees and towards experienced specialists and adaptive engagement models like contract-to-hire. Nearshoring within LATAM will start to pick up, driven by both cost-effectiveness and changing geopolitical motivations.

When will the tech job market recover?

Many signs are pointing toward a rebound by late summer to early fall of 2025.

Why? Two prime forces are converging:

- The Federal Reserve will most likely ease interest rates by Q3, unleashing new capital for startups and large-enterprise technology ventures.

- A deluge of nearly 2,000 well-capitalized IT startups that started late in 2024 is beginning to scale very rapidly, and they’re requiring top-class talent, pronto.

So, is the tech job market improving? Yes — but selectively. Hiring trends in technology show strong demand for senior-level and specialized roles, such as those in AI, cybersecurity, and cloud infrastructure. They’re creating a digital-first infrastructure and recharting business models on automation, cybersecurity, and AI. Historically, this kind of forward-thinking hiring is a sign of general recovery in tech.

Thus, while junior and generalist job demand may perhaps remain subdued, specialized and senior-level tech experts are poised for a high level of opportunity. History suggests that when specialized hiring booms, general recovery follows.

A Strategic Window for Both Employers and Talent

This brings us to a critical inflection point. Companies are optimizing recruitment with AI-based hiring solutions, while talent is adapting to machine-readable resumes and real-world skill assessments. And with the software engineer job market demand increasing, seasoned professionals have the chance to reenter or reposition themselves for high-value roles.

Whether you’re wondering how many jobs are available in technology or when will tech hiring pick up again, the short answer is: now is the time to prepare.

The IT job market in the US in 2024 may have looked bleak, but as of mid-to-late 2025, the tech job market outlook is shifting. It’s time to take advantage of this rare supply, demand, and strategic transformation alignment.

So, as a result:

- For employers, acting now means securing critical talent at rates that may not last as the market tightens.

- For candidates, the next six months are a window to specialize, network, and show measurable results that AI hiring platforms can rank and recognize.

Outlook: When Will the Tech Job Market Get Better?

The US tech job market is not just stabilizing but also transforming. After two madcap years, the sector is in a wiser, leaner phase of specialization, robotics, and value creation. AI is not taking jobs away — it’s recasting them. And while junior-tier roles may still be scarce, demand for senior, AI-educated, and infrastructure-intelligent talent is racing ahead.

For workers, it is an unusual opportunity to hire with long-term impacts before competition gains momentum and salaries rise. For career seekers, it’s the moment to recreate your value and associate with companies building tomorrow.

We at Unitecode assist technology businesses in hiring smarter and growing faster – from hiring AI-inclined developers to constructing full-stack teams that deliver. We also help talent secure top-impact roles aligned with technology’s future. Whether hiring or looking, Unitecode knows how to move you ahead! Let’s talk.

Frequently Asked Questions

Is the tech market recovering in 2025?

Yes – slowly but surely. By Q4, we foresee a turning point, with high-skill roles in the spotlight. The late 2025 outlook for the tech employment market is good for senior and AI-expert professionals.

Does the tech industry have a future?

Yes. With continued investment in AI, cybersecurity, fintech, and clean energy, tech is the cornerstone of global growth.

Is it worth getting into tech in 2025?

Yes. The sector awaits skilled players with the capability to upskill fast. AI, cloud infrastructure, and cybersecurity are needed.

What tech job is future-proof?

AI/ML, cybersecurity, DevOps, cloud engineering, and data science jobs are future-proof. They’re inextricably connected to the evolving needs of digital transformation.

How is the current tech job market in the USA?

It is recalibrated and selective. Experienced and expert talent is needed, while junior positions are limited.

Which technology will be in demand in 2025?

AI, ML, blockchain, cloud platforms (AWS, Azure), and cybersecurity tools will dominate. Technology hiring trends point towards automation, data-driven decision-making, and security-first development.